Erie’s Town Finances: $4 Billion Valuation, and How Each One Of Us Are in Debt Because of It

Andrew Sawusch • January 21, 2020

While the Town's population has grown, so too has the debt. Over the years, the town has found ways to avoid attributing debt to their legal limit, including using the properties of Erie residents as their assets of value, which ultimately increases your monthly water bill

Reader beware!

The analysis below on the Town's finance is regarding a super complicated subject: the Town's debt. I had to get very nerdy for it, but it's an extremely important topic. I created a "Quick Read" section of the bullet points if you don't want to read the full analysis. For the full analysis, keep reading below, or click here for the full analysis.

(Begin - Quick Read)

Summary:

- Your water bill is high because of the debt practices that the Town uses ($45 if you don't use a single drop)

- Your water bill includes a substantial amount of debt payments buried within it

- All of the Town's major revenue centers revolve around debt associated with water, sewer, and storm water drainage

- The Town's current debt is reported as ~$15 million, but is actually over $200 million

- The Town's largest revenue sources are debt, water/sewer/storm water, taxes, and residential development.

- The Town's debt limit is set based on the total of all property within Erie, including the property of Erie residents

- The Town's residents each have a debt of ~$3,233 (or more) per person because of the Town's debt practices

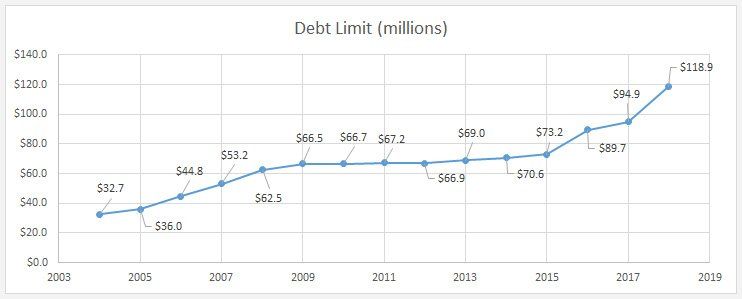

- The Town's debt limit has increased ~79% in the past 10 years alone

- The Town has found 2 different ways to avoid their debt limit, and does not have to report all of their debt towards it

- The Town's management is "of the opinion that its Water, Wastewater, Storm Drainage, and Airport operations qualify for this exclusion" to not be limited by the Town's debt limit

- The Town's 2020 budget is a net deficit due to more expenses than revenues, because of large infrastructure items

- The Town funds these projects through bonded debt, increasing the Town's overall debt

- The Town

requires

residential development in order to increase their debt limit

- The Town requires residential development in order to increase their debt for water, sewer, etc.

- The Town requires residential development to increase their tax revenues

My Stance:

- The Town must stop relying on debt to fund every single one of their infrastructure needs

- The Town must stop relying on water revenues to fund almost every one of their budget items

- The Town must stop relying on residential developments to fund almost every one of their budget items

- Ensure equitable relationships with developers, assisting with the Town's needs, and within the vision set by the Town

- When possible, the Town must work with the developers to use their resources to build our infrastructure, and then provide them with reimbursements for doing so - work with them so we can "cross two 'Ts' with one stroke of the pen."

- The Town should not use a "moratorium" or "ban on all future developments": Boulder tried it, now it has become too expensive to live in Boulder

- I am in no way, shape, or form saying to build as many houses as possible. I am saying responsible development, equitable development for the developer and the town, and working with responsible developers in a responsible way that is Forward Thinking

(End of Quick Read)

-----------------------------------------------------

(Begin - Full Analysis)

If you continued to this point, thanks! I do want to warn you in advance - this is extremely complicated, and it might take a moment to sink in as to how the Town is bonding out their current debt. If you have any questions at all or would like to discuss this, feel free to reach out. Thanks again!

During the middle of every year, the Town of Erie provides their Comprehensive Annual Financial Report

(CAFR), which provides an in-depth analysis of the Town’s financial strength as it relates to the previous year’s activities. Currently, the Town provides on their website the CAFRs from 2004 through 2018. Each of these reports are audited by a 3rd party for correctness and completeness prior to being made publicly available. The information that the CAFR discloses is a complete overview of all Town activities, based on the records provided from the Town’s Finance Department and the other various Town departments.

From the report, it appears that the Town is financially strong, healthy, and in a great position for the future! Well, yes, and no.

When reviewing the "Changes in Fund Balances/Working Capital" section of the 2020 Budget, there is a line item for over $92 million of expenses for the “Enterprise fund”, relating to Water, Waste Water, Storm Drainage, and the Airport. A large majority of the budgeted request, over 61%, is related to capital expenditures for the Windy Gap Firming Project ($36.6 million) and the North Water Reclamation Facility expansion ($20 million). Due to these and other projects noted, the "Enterprise Funds" are budgeted to have just over $13 million more in expenditures than revenues, delivering 96.6% of the overall deficit estimated in the approved 2020 budget.

You might ask, "How is that possible, why is there a deficit? How will the Town pay for these projects and the other Town activities?" Well, further down in the budget, there is a line item for “Debt Services” of approximately $1.5 million. You might initially think that this is something to the effect of principal and interest payments towards the current and future planned debt of the Town. Sorry, you would be wrong - that is only a portion of the Town's debt, relating only to the current "General Obligation" debt.

But you did raise a good question: how is the town paying for these projects? The answer: It’s tricky, not at all simple, amazingly ingenious, but terribly deceptive.

The Town’s Debt Limit, and Issuance of Debt

As noted in the 2018 CAFR, “State statutes limit the amount of general obligation debt that the Town may issue to 3% of estimated actual valuation.” At the end of 2018 this limit was a “Legal Debt Margin” of ~$104 million. When you do the math on this, it means that the valuation is near almost $4 billion. Below is a graph which visually shows just how much this debt limit has climbed between 2004 and 2018 alone:

You might ask, "Wait, are you telling me that the town has an actual valuation of almost $4 BILLION?!?!

How is that possible?" Well, no, but technically, yes. (and here’s where things become scary) We the residents of Erie - our collective properties are the assets.

Based on an aggregated total of the value of properties within Erie, the 2018 estimated "Actual Taxable Value" was $3.7 billion, and the "Total Primary Government Outstanding Debt per Capita" is $3,233. That’s right! We, the residents of Erie, each have a share of the debt placed on each one of us to the tune of $3,233 per person.

But wait? The Town only says in the CAFR that they have an “Outstanding General Bonded Debt” amount totaling

~$15 million? Well, no, not really. The Town's actual “Total Direct and Overlapping General Bonded Debt” is $1.34 billion, with the Town’s share being ~$141 million, in addition to the debt from the "Total Primary Government Outstanding Debt", which includes the issuance of bonds for the Town's “Enterprise” activities.

What is an “Enterprise fund” you ask? This is the fund for activities as it relates to the expansions, improvements, and other activities related to water, waste water, storm drainage, and the airport. Hypothetically, say that the town wants to build an expansion to the North Water Treatment Facility (*wink, wink*). The Town would pay for this project by issuing additional debt by way of bonds.

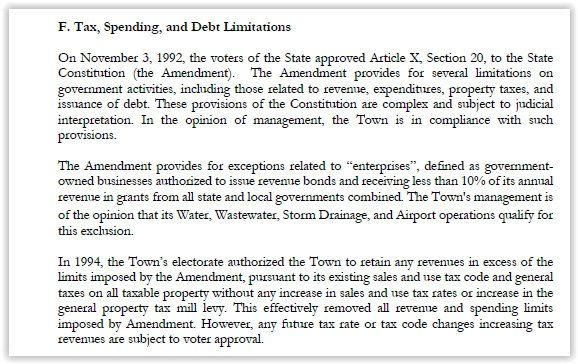

As the Town’s CAFR states, Article X, Section 20 of the C.R.S. "provides for exceptions related to "enterprises", defined as government-owned businesses authorized to issue revenue bonds and receiving less than 10% of its annual revenue in grants from all state and local governments combined. The Town's management is of the opinion that its Water, Wastewater, Storm Drainage, and Airport operations qualify for this exclusion."

What does this mean? It means the "Town management is of the opinion" that they can legally incur debt by issuing bonds, without applying it to the Town's debt limit, which our properties are the assets being valued. The yearly CAFRs began including this statement and section back in June of 2012, when the 2011 CAFR

was released, which was also the first CAFR released by the then new Town Administrator, as well as the then new Finance Director. Although they would have been the first “Management" individuals which publicly disclosed that they deemed this action by the Town as warranted, this same practice, but without this specific statement, was ongoing since before the 2004 CAFR. This means that the Town has taken the stance of not including Enterprise fund debt in their general obligation debt since before 2004, and every year forward, as it relates to their debt limit.

The Town's Debt and its Relation to Your Water Bill

You might be thinking now, "Time out. Is this why my water bill is so high?" Yes, this is exactly why your water bill is so high!

Up until the 2011, the same year that the "Tax, Spending, and Debt Limitations" section appeared for the first time, there was a "Compliance Section" within each CAFR which noted for each debt bond, “The town is required by certain debt covenants to maintain rates and charges for the Water water system for each calendar year in an amount sufficient to:

- Pay Operating Expenses

- Pay any amount required by a debt service reserve

- Pay at least {% listed below} of debt services due to {name of bond listed below} loans and revenue bonds"

Here are just a handful of the bonded debts, and the disclosures provided within the pre-2011 CAFRs, as well as the percentage that is mandated to be covered within each water bill paid by residents:

- Waterwater Colorado Water Resources and Power Development Authority (CWRPDA) = 110%

- 1997 Wastewater Revenue Bond = 125%

- 1998 Water Refunding Bond = 125%

- Water CWRPDA 2004 Loan = 120%

This means that a percentage of your Town water bill isn't just paying for costs and expenses to operate the water department, or for water rights, but also for the interest, as well as the above and beyond mandated and contractually obligated percentages set when the bonds were issued.

But wait, I’m not done!

Starting in 2005, when the town purchased Colorado-Big Thompson water shares , the CAFR included the following statement: “Through the Erie Finance Corporation (EFC), the Town issues Certificates of Participation (COPs) for the acquisition and construction of major capital facilities and improvements. The COPs are secured by the constructed facilities and improvements. The debt service payments are made from the rents collected by the EFC based upon a lease purchase agreement between the Town and the EFC. The improvements and outstanding COPs are recorded on the Town's financial statements as capital assets and capital leases, respectively.”

Some of the previous years statements have further gone on to say, “The COPs are secured by the underlying capital assets. Payments are subject to annual appropriation and do not constitute a general obligation or other indebtedness or multiple fiscal year financial obligation of the Town within the meaning of any constitutional or statutory debt limitation.”

Basically, the town issued COPs in 2005, which are a fancy way of saying "debt", for the acquisition of water that cost just over $32 million. This means that not only does the Town have one mechanism to skirt their debt limit

through the "Enterprise Funds" account, they have two, also through the EFC. I kid you not, I couldn't even make this stuff up if I tried!

What Does Water and The Town's Debt Have to Do with Each Other

Ok, so what does this all mean? This is where it becomes even more complicated.

When more people use the water, waste water, and sewer facilities, and when our infrastructure reaches the point where they are in need of an expansion, the Town must be able to come calling to financiers, and offer the Town’s AA1 Moody’s rated bonds or the Water Department’s AA3 Moody’s rated bonds. Because the “Town management is of the opinion” that these debts do not have to be counted towards the debt limit, that means they will simply continue issuing debt to pay for facilities. Then, they will be mandated to increase water rates incrementally every year, essentially through new assessments, which would include the new financing that they secured through bonds. The rates are set based on a

"Utility Study Report" rate analysis every 5 years, which are completed by contracting an outside firm, and then submitted for approval by the Town's Finance Director.

While residents pay their ever increasing water bills, the bonds, which are paid off many years down the line, are allowing the Town to make money hand over fist along the way. Meanwhile, the EFC, which is owned by the Town, and uses the facilities as collateral, in turn rents the infrastructure facilities back to the town, which are also owned and operated by the Town. The town then only accounts the leased facility expenses back to the budget, rather than the entire funded amount. Since, the town does not account the "Enterprise funds" towards the debt limit, they are first required to show that there are enough customers warranting the project (ie. consumption and use of the systems and facilities), and that the rates set pay for the project plus additional fees above and beyond. The Town can choose to first add the bonded debt to their "General Obligations" to secure the funding and then transfer it to the "Enterprise Funds" account to avoid the debt limit, or they can simply take on the new debt directly to the "Enterprise Fund" account and avoid the debt limit all together.

Concurrently, when the “Actual Taxable Value” for properties within the Town increase, meaning the land and our structures increase in their appraised values, or improvements are completed to increase the value of the land, or as more homes are incorporated into the Town, the debt limit can be increased due to the increased aggregated total. In simultaneous fashion, the tax revenues increase because there are more properties that are taxable, and the previous properties that are now improved increase in the taxable amount too.

Get all that? In lay man's terms: The Town has not only needed residential development, it has required residential development simply for their three largest revenue sources: taxes, water/sewer/waste water, and developer contributions.

Residential Development Agreements: What the Developers Pay

Now that we understand how and why the Town has become dependent on residential development for their future debt needs, as well as their needs for revenues related to their “Enterprise fund" activities, it is important to look at exactly how this relates to the current residential development agreements that the Town enters into for each new development.

When it comes down to the developer agreements, there are specific items which the developer pays for and is on the hook for to improve and develop their land for their uses. Those types of improvements are categorized into "Public Improvements" which include the following:

- Infrastructure costs: Water infrastructure, tap and connection fees, sanitary sewer and storm drainage infrastructure, sediment and erosion control infrastructure, drainage infrastructure, on-site and off-site utilities (electric, natural gas, telephone, cable, etc.)

- Common facilities, common area landscaping, and parks: trees, grass, fencing, native areas, and other like-kind items, as well as the landscaping maintenance which includes weed control and mowing of vacant lots

- Streets fees as it relates to their immediate development: Streets and concrete drives, sidewalks, signs and striping, street lights and street signs

There are as well additional fees that the developer incurs, which include the following:

- Permits: Building Permits, Public Improvement Permit, US Corps of Engineers, Colorado Dept of Health and Environment General Permit for Storm water Discharges Associated with Construction Activity, Town Grading and Storm water Quality Permit, Air Quality Permit

- Reimbursed to Town: Developer reimburses the town for any expenses incurred by the town for consultant review of applications/documents

- Developer Expenses: Testing and Inspection fees, supervision and professional licensed engineer services

Typically, the Town will provide a concession for the following types of improvements, through the form of reimbursements, after the Town has accepted the developer’s improvements: actual incremental costs for the over-sizing of large non-potable and potable water lines, extensions of already existing streets.

Before any grading of the land begins for a new development, the Town will hold a set of funds from the developer, generally 115% of the total actual cost of construction and installation of improvements, which will then be held by the Town until the time that the Town has accepted the improvements as complete. These funds can be used by the Town if the developer does not make the improvements as deemed adequate by the Town. When the improvements are completed, the Town will reduce (ie. give back a large portion of the funds) so that the amount held is reduced to 25% of the original improvements total, which is then set aside as a 2-year warranty period for use as an “Improvement Guarantee”.

As well, the town might require that specific tracts, or plots of land, be transferred to the Town through conveyance of special warrant deeds for use as “Open Space”, or so that the land can be used as a Town park within the community. Typically, this will also include the requirement of an additional specified dollar amount provided from the developer for the Town, in order to build improvements to the park.

The Developer's Contribution to Our Town's Revenues

When all is said and done, and the land becomes improved, the Town records as revenues all of these public improvements in public areas or future Town owned right-of-ways that the developer makes. Additionally, the town then receives increased tax revenues from the new homeowners due to the taxable improvements made to the land:

- Capital Grants and Contributions: Includes the contribution of infrastructure built by the developer from improvements

- Charges for Services: Includes the developer's building permit fees, water use fees, and tap/connection fees

- Taxes: The developer still pays for the taxes on the individual parcels of land during construction, and then the new homeowner pays for the "taxable improved value" once they purchase the home and it is transferred to them

As mentioned previously, the Town relies heavily on revenues being contributed from "Enterprise fund" accounts, as well as from taxes. But more importantly, the Town has been much more reliant on residential development. When it comes down to the financials, the Town has hung onto residential developments as the way to pay our Town's bills. The graph below shows just how many permits have been issued by the Town between 2004 and 2018:

When you review just how much developers contributed to our Town's "financial health", it becomes shocking. The graph below shows just how much of the Town's revenues and expenses have been effected by residential development:

My Stance: The Changes Necessary to Stabilize Town Revenues

The Town, must first stop relying on debt for every one of their capital expenditure needs. We must become independent for ourselves, and must begin to find ways to self-fund our projects. While debt is fine in certain situations, the way that the Town has been using it for over the past decade is becoming reckless. We, the residents of Erie, are on the hook for it. We, the residents, are the ones who must pay for it through fees packed into the various Town activities.

Second, the town must stop relying on water to fund almost every piece of the Town's expenses. We the residents of Erie, are the ones paying for it monthly through our water, storm drainage, and sewer utility bills. Even if we do not use a single drop of water for a month, resulting in not a single drop of sewer usage, we would still pay $45.68 for the month, with a large portion of that being used just to pay for the debt that has been financed by the town.

Finally, the town must stop relying on residential developers to pay for our infrastructure and, as is the same with water, almost every piece of the Town's expenses. Yes, developers should be paying for the improvements that they make on the land that they develop. But we should not be to the point, as we are, where our financial stability is determined by them. The new developments have increased our population faster than our current infrastructure can handle, resulting in expansions and new infrastructure needs that the Town looks immediately to financing through bonded debt. This method is not sustainable, and if there were to be an event causing a situation like 2007 - 2014, we would all bear the burden through future assessments and tax hikes to cover any possible long-term downturns in the economy.

The answer should not

be a "moratorium" or "ban all future requests". Boulder (the city) did this, and look what happened - no one can afford to live there! The answer is to make sure that the Town's resources can accommodate the requests, and in very specific cases, work with the developer to add additional infrastructure pieces that are needed before they break ground or concurrently as they break ground, in terms of building the developments very first homes. If it means that the town can outsource specific infrastructure needs to them, instead of having to do every project on our own with the limited resources available - cool, I'm game! As long as it meets our quality standards, is adequately improved to the level that we deem fit as provided in our Town's UDC and by State codes, and is most importantly within the cost and time-frame that the we as the Town define, it's a win-win for us both.

Yes, it might take them just a little longer than the developer would like in breaking ground, but you know what, it means that we have the infrastructure in place to support the growing population before

those new homes are built, and we can invest our limited resources into other areas which we are simply unable to receive assistance in from outside parties. Because let's face it - the developers are also the ones adding to our growth problem, it isn't just us accepting all of these development agreements. Instead of creating ill-will with them and responding negatively towards them, let's work with them, tell them our vision, define our needs, what we would like to have done, and be able to set a path forward which is equitable and profitable for both parties. If they are building a new road specifically for their new community, and we also have needs to widen a road that the new road would be intersecting, work with them so we can "cross two 'Ts' with one stroke of the pen." It becomes more efficient, and would save time and costs associated than it would if each project were done separately on their own. It would be the exact same situation as the Town currently does for items such as when a developer is reimbursed by the Town the actual incremental costs for having to install larger water lines than are pre-existing in order to fit the increasing needs added by their newly added community.

I am in no way, shape, or form saying to build as many houses as possible. I am saying responsible development, equitable development for the developer and

the town, and working with responsible developers in a responsible way that is Future Thinking.

Topic for Next Time: Economic Development

Since I have been asked about my stance on a wide range of topics, I will be releasing a calendar this week, which will have the specific release dates and topics which I will be addressing in my future articles. There are many topics that I have received questions about, which I will be addressing in the same method just as I have this topic and those topics discussed in my previous posts.

If there is a specific issue item that you would like me to address, please fill out the form on my website, available here. There will be some articles where I will be doing a "Q&A", so I might just answer your question directly! The most requested topic already of "Oil & Gas / Fracking" will be a future article, which I will fully address in its entirety just as I have this and other topics. I will as well be addressing in future articles the topics of "Home Rule" and "IGA/Relationships with Local Municipalities/Agencies" as those are also "Hot Button Topics" which I have been asked to address.

I greatly appreciate you taking the time to read this article on Town Finances and look forward to hearing your comments and feedback relating to it. Since some Facebook groups are beginning to shutdown the comments sections, please free to leave a comment below. Thanks again!

*Just a side note to all of the items that I discuss: I am a solutions driven problem solver by nature. I wonder how things work, why they work the way they do, and how to make them better. This means seeking different, outside-the-box methods to figure out solutions to various issues. Accordingly, I am always open to learning new ideas, different ways of doing things, as well as constantly learning from others' experiences to make better decisions. When I see an issue, I view it in a holistic fashion, and then dive into specific areas to remove deficiencies and create efficiencies. If you, who are reading this, have some thoughts or ideas about any of the subjects I discuss, I would be more than happy to speak with you to hear your opinions. Listening, hearing, and understanding different perspectives is the only way that we can all grow and create positive change - by learning from others, and delivering ideas that push the needle to become Forward Thinking.

Share

Projected to be depleted by 2027, Erie's finance team forecasts the Town's Capital Fund to only have $2.5million available for capital projects (after $4million Street Maintenance) from 2027 through 2029 — due to overspending caused by operational and capital expenses exceeding the growth of revenues

While some call it an "Affordable Housing" issue, in reality the root of the problem is a lack of housing diversity. During the Town's massive growth over the years, a lack of available inventory and the national housing market have created a housing affordability issue as the Town's makeup has comprised almost entirely of single family homes. The best way to resolve this issue is to work with our stakeholders in the community - our development partners - to address the cause, not the symptoms of the issue.

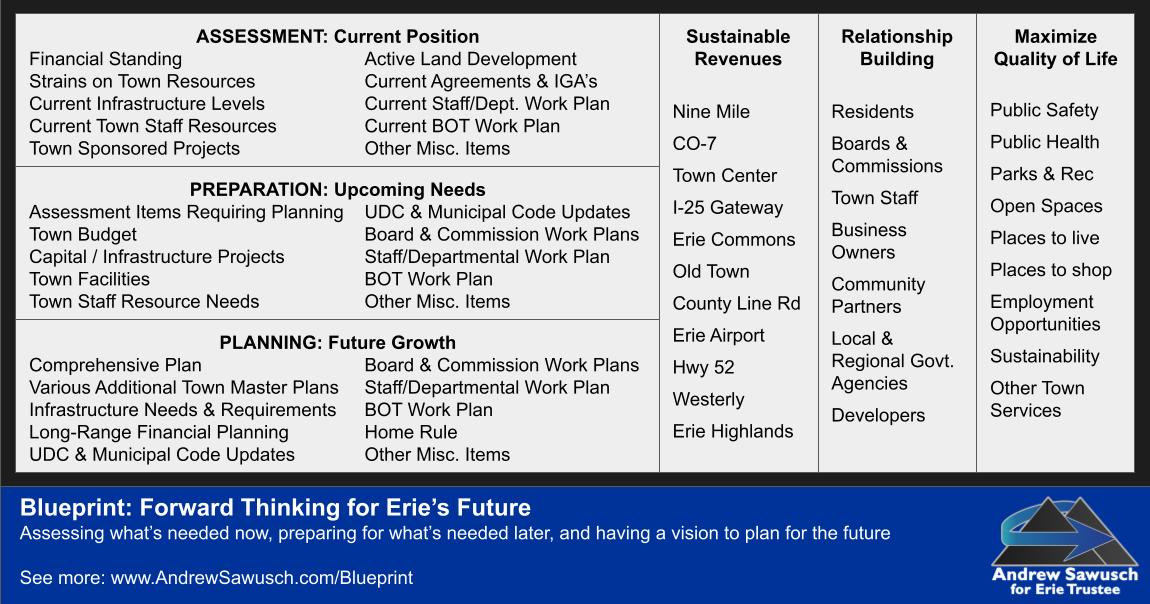

Erie has quickly moved from "the best kept secret" to "the gem of North Metro Denver", becoming a destination that others want to call home. In order to set our Town up for the best chances for success, a plan must be created that provides us with an ability to manage our current and future growth.

The blueprint below is designed to do just that, providing an understanding of where we are now (our "Current Position"), where we are going (our "Upcoming Needs"), and where we want to be (our "Future Growth"). It starts with assessing what's needed at this moment, preparing for what's needed later, and then having a vision to plan for the future.

Tell us briefly about yourself and where you are from and why you think you're a good candidate for the position you are running for: Originally from the Chicagoland area, I have been a resident of Erie since 2016, previously a resident of Broomfield for 7 years. I graduated from CU Boulder in 2009, with a Bachelor of Science degree in Business Administration with dual concentrations in Management and Marketing. I am a business operations and marketing professional, with experience growing businesses from the ground up. Currently, I serve as the Sr. Manager of Customer Operations for a data analytics software company. As a solutions-driven individual, I use a holistic-view approach to identify and resolve issues that deliver results, which are both effective and efficient. I am married to my amazing wife, Gabrielle, and am the doting father of my two husky fur-babies, Kaia and Koda. I currently serve as both a Planning Commissioner and a Comprehensive Plan Amendment Steering Committee member for the Town. As an individual from the business world, I believe the Town needs leaders who can create solutions that will be positive and Forward Thinking for Erie’s Future. I believe that I am a good candidate for the position of Trustee because I am committed to making Erie the thriving and sought-after place to live, work, and raise a family - the place we love to call "home"!

I have recently been asked my stance on the Town's current face coverings order. This is an issue which by now, I am sure we have all formed our own personal opinions on. Since 2020, it has affected our daily lives and has been a “hot topic” locally, nationally, and world-wide. It has created division between families, friends, neighbors, communities, and nations alike – and likewise, Erie too has also seen its fair-share of division surrounding the subject. Personally, I abide by the orders issued by a county’s Public Health Agency, as their respective agency has final-say on the specific orders currently in place within their respective boundaries. As well, I abide by the requests and policies of a business which may not be under a mask mandate, but request that patrons within their establishment wear one. However, as I will go into further, the current Town of Erie Face Covering order is in actuality an overreach of legal authority applied to the Weld County side - due to Erie not having its own Public Health Agency, and due to Public Health order which was referenced in the Town's order being from the Boulder County Health Department. The decision made by the Board of Trustees and Town Administrator to administer this upon those in Weld County has not only hurt our businesses, but it has as well placed our Erie Police Department in a situation which they have no option but to enforce the order. The Erie Face Coverings Mandate Erie is uniquely situated in a location where we are split between two counties, with each county having differing views when it comes to various topics – and COVID has been no different. Statutorily, CRS §31-15-103 notes that the Town has the power to issue ordinances “which are necessary and proper to provide for the safety, preserve the health” of the Town’s residents. As well, we are statutorily provided with the authority to create our own Board of Health, as described in CRS §31-15-201 (1) (c), as well additionally in CRS §25-1-507 which notes:

First off, this issue has nothing to do with the capabilities of our Town's current Finance team. I am in no way, shape, or form "throwing them under the bus." I think they are doing a fabulous job, and are making amazing strides in rectifying many issues that they ultimately inherited. These issues should have been found out sooner, and lies entirely and squarely on the shoulders of previous Board of Trustees, as well as our Town Administrators. These individuals are the leaders within Town Hall. They are the individuals who are either our elected, or appointed by those elected, to be Stewards of our Town's finances. Our next board must contain individuals who understand the Town's budgets and finances, who review them thoroughly - as well as those who provide scrutiny, ask questions, and request clarification on these items (and others) from Staff. As someone who believes that our Town's Financial Wherewithal is an extremely important topic for our Town's future success, and having identified this issue in 2020 , I am disappointed in our Town's leadership for placing this situation upon our Town's Finance department. I am providing this information because of the opaque nature in which our Town has acted with in years past. I am also providing this information because there are many more issues that these individuals are attempting to rectify at this very moment, some that might take a year or two to finally be able to accomplish, as well as to say to our Town's Finance Department (Stephanie and Candice - and Victoria who just left as well) "Thank you for all that you are doing to illuminate and resolve these issues for our Town!" Backstory After my last article regarding the Town's 2022 Budget and the changes made within, another Trustee Candidate and myself were discussing the Town's budget online, referencing both the Town's Comprehensive Annual Financial Report's and Monthly Financial Reports in our comments. Less than a week later, I noticed that the Monthly Financials were removed from the Town's website. I decided to post on my Candidate Page about this in jest, and tagged the Town's official Facebook account - assuming that I wouldn't actually receive a response about it.

The General Fund is the primary operating fund for the Town. This single account is where all revenues and expenses are allocated relating to Town Administration, Legal, Legislative, Parks and Recreation, Public Works, Finance, Economic Development, Communications and Community Engagement, HR, IT, Public Safety, and Central Charges (ie. Debt and Transfers to other funds). The revenues that fund this account results from our sales taxes, property taxes, development related fees, recreation fees, landfill fees, oil and gas related income, and other miscellaneous sources. Adopted by the Board of Trustees in November, this year’s budget was prepared for the first time in over 10 years by someone other than our previous Finance Director. The 2022 General Fund Budget projects a total of approximately $42.6 million in revenues for the Town. This is an increase from approximately $36.1 million in 2021, for a year-over-year growth of $6.5 million or 18%. At first glance this might look great, but the Budget then continues to explain that this double-digit growth is largely just a result of an “accounting change.”

As we all practice social-distancing and isolation due to COVID-19, what happens when we run out of activities to do around the house? Below are many different items - ALL COMPLETELY FREE - including educational materials for children, books, music, and virtual activities, in order to continue learning or simply pass the time. Have more items to add to the list? Send me a message here or on Facebook . (I will continue adding to the list as additional suggestions come in - but remember, they must be FREE!) ACTIVITIES Fitness 1440 - Erie Virtual training for its members on their Facebook page, to help stay mentally and physically active (On-Demand FREE for current members, Facebook video classes also posted for current and non-members) (just a side note: you can still also purchase their smoothies, picking them up curbside from 10am-12pm, by texting or messaging your order to them!) https://www.facebook.com/fitness1440erieco/ Virtual Field Trips Take a virtual trip to locations arround the world: View exhibits from The Louvre Museum in Paris, the Anne Frank House in Amsterdam, explore the surface of Mars, and more http://freedomhomeschooling.com/virtual-field-trips/ Virtual Disney World Rides Even though the Disney parks are closed, you can still ride their rides virtually online https://www.wesh.com/article/virtual-disney-world-rides/31782946 Paris Musées Virtual Exhibit Collection of 150,000 digital art reproductions in High Definition of works in the City’s museums http://parismuseescollections.paris.fr/en GoNoodle Movement and mindfulness videos created by child development experts https://www.gonoodle.com/ CHILDREN'S EDUCATIONAL MATERIALS - GAMES, LEARNING, & VIDEOS Khan Academy Expert-created content and resources for every course and level (requires sign-up) https://www.khanacademy.org/ Newsela content from the world's most trusted providers and turn it into learning materials that are classroom-ready https://newsela.com/ XtraMath Program that helps students master addition, subtraction, multiplication, and division facts https://xtramath.org/ Teachers Pay Teachers Online marketplace for original educational resources with more than four million resources available for use (requires sign-up) https://www.teacherspayteachers.com/ Create Printables Variety of worksheets and printables ideas to personalize for your child https://www.createprintables.com/ PBS Kids Educational games and videos from Curious George, Wild Kratts and other PBS KIDS shows https://pbskids.org/ Sesame Street Play educational games, watch videos, and create art with Elmo, Cookie Monster, Abby Cadabby, Big Bird, and more of your favorite Sesame Street muppets https://www.sesamestreet.org/ Education.com A library of games, activities, educational worksheets, and lesson plans for PK-5th, curated by educators (requires sign-up) https://www.education.com/ BrainPOP Animated Educational Site for Kids - Science, Social Studies, English, Math, Arts & Music, Health, and Technology https://www.brainpop.com/ (Normally this is a paid subscription service, but they are offering free subscriptions due to the COVID-19 pandemic) Starfall Allowing children to have fun while they learn - specializing in reading, phonics & math - educational games, movies, books, songs, and more for children K-3 https://www.starfall.com/ BOOKS (KIDS AND ADULTS) Magic Blox Offers a large library of free online books & children's stories https://magicblox.com/ Epic! Digital library for kids offering unlimited access to 35000 of the best children's books of all time (30-day free trial available) https://www.getepic.com/ Open Library Collection of books from the Library of Congress, other libraries, and Amazon.com, as well as other contributors https://openlibrary.org/ Project Gutenberg Library of over 60,000 eBooks, including free epub and Kindle eBooks, download them or read them online https://www.gutenberg.org/ TV & MOVIES Tubi Stream and watch movies and TV shows online in HD on any device https://tubitv.com/ Pluto TV Watch 250+ channels of TV and 1000's of on-demand movies and TV shows https://pluto.tv/ MUSIC Spotify Digital music service that gives you access to millions of songs https://www.spotify.com/us/free/ Pandora Music streaming and automated music recommendation internet radio service https://www.pandora.com/ TuneIn Radio Internet radio, sports, music, news, talk and podcasts https://tunein.com/

Current and previous leaders have not addressed the items which they said they would. As a resident, I am tired of seeing Erie's potential squandered. That is why I am saying "no more!", and why I am running for Trustee. This is why I will focus on the most pertinent issues that I see, as well as the items that are most important to you, the Town's residents