Erie's Debt: How Water Funds the Town's Operations and Why the Town's Debt Practices Matter to All Erie Residents

Andrew Sawusch • January 23, 2020

Addressing the many questions received regarding the my original "Town's Finances" blog post, how your water bill funds the Town's operations, and why both "Total Debt" and "Debt Per Capita" should matter to all of Erie's residents

This is a continuation and provides additional details for my original article on "Town Finances", which analyzes the Town's financial practices, namely how it has been incurring vast amounts of debt, using water revenues, and residential development to pay for the Town's operations. I have been receiving many questions regarding the topic, and wanted to address them in an appropriate forum, since social media, in my opinion, is not the proper setting to do so.

How Your Water Bill Actually Funds the Town's Operations

I was asked a question as to how exactly the Town is able to use your (minimum $45-$75) water bill payment and the funds from "Enterprise" (water/sewer/storm-drainage) revenues to fund the town-wide operations, since they are supposed to be "independent" from other accounts.

I am going to go through this all in a different way to allow everyone an opprtunity to understand what I have come to learn. I will as well answer each of these questions directly at the end.

The Town issues “budgets” and “financial reports.” Both are very different, and almost never result in the same figures/totals.

“Budgets” are issued by the Town’s Finance Department. They are “assumptions”, “estimates”, and “forecasts” based on a full year’s activities, accounting for the estimated revenues and expenses that will be incurred/received by December 31st of that specific year. Each year, ,there are even "supplemental appropriations" budgets to reflect changes in revenues, or new expenditure requests.

“Financial Reports” are reported by the Town’s Finance Department

to the best of their abilities, reflecting the actual totals for the given period of time. There are some discrepancies that will occur any given month or year as the finance department receives or defers certain revenues and expenses, which are noted as “adjustments” in future reports.

“Comprehensive Annual Financial Reports” (CAFR) are issued by the Town

in May or June of every year, reflecting the actual amounts of all activities from January 1st through December 31st, and they are audited by an outside 3rd party (except for the statistical sections and disclosures for the “Enterprise funds”, and a few other items). These reports indicate the actual revenues and expenses of all Town-wide activities, including both liquid (cash and investments) and non-liquid (capital improvements, machinery, buildings, etc.) revenues and expenses. These are actual totals, but again, “adjustments” do occur frequently and are reported in the next year’s report.

“Monthly Financial Reports” are issued by the Town

a few months after the month’s-end of that specific reported month, and are not audited by a 3rd party. These reports indicate the actual revenues and expenses of all Town-wide activities of both liquid and non-liquid revenues and expenses for that given month. Again, there are adjustments that occur between the full CAFR and the month’s-end report issued for the last month in a calendar year.

I am contending that the Town has a cash-flow problem up until June, meaning they do not have the necessary funds on-hand specifically for funding the Town’s operations. I am contending that they are using the Town’s water bill payments to fund the Town’s operations. This means that we have to look at financial reports, not budgets. Specifically, we have to look at the “liquid” assets, meaning actual cash transferred to or from the town, since we ONLY want to view the actual amounts of cash received and expended, not the estimated. Budgets will include all funds expected to be received, both liquid and non-liquid, but they do not show exactly when the funds are in fact received.

Since “liquid” assets are all that I am looking at, this means the cash and investments “Held Directly” is all that matters. The Town directly holds “liquid” funds in two forms – cash and investments.

For investments, an extremely large majority of these funds can only be used towards the funding of very specific expenses – they can’t be used for just anything they want, and are restricted from being used in that way. The Town’s policy described in the CAFR is to allow the funds to remain in the investment portfolios “so that investments mature to meet cash requirements for ongoing operations, thereby avoiding the need to sell securities on the open market prior to maturity.” The “pooled investments” as reported (and indicated in the graphic I present below) are for “ColoTrust, CSIP, Blackrock”, which are the “short-term” or “fixed-term” investments that “are not immediately required to be disbursed.” This means that these investments remain in this account until they are absolutely needed for disbursement.

For “liquid” cash, the Town’s revenues are volatile in terms of the actual month they are received or expended. The Town receives “liquid” cash funds throughout the year in many different forms to fund the Town’s “General Fund” (ie. the account that funds all of the Town’s operations, except water/sewer/etc.). 82% of these funds are received in a monthly fashion (as in 1/12th of all expected funds are expected to be received each month), 13% from property taxes received within the months of April-June since this is when property taxes are due, and 5% received at various times of the year for various other reasons.

So, to best show the Town’s “cash flow” in the best method possible, the graphic seen below shows the complete amount of total “liquid” funds reported and “Held Directly” by the Town. These amounts are “as reported” by the Town, based on the Town’s 2018 CAFR, as well as each following month’s Monthly Financial Report (except January 2019, since a Monthly Financial Report was not provided by the Town). This graphic represents all “liquid” funds controlled by the Town, from December 31, 2018 through July 31, 2019, showing exactly how and where these funds were either received or expended.

The Town started the 2019 year with a “Total Held Directly: All Pooled Cash and Investments” balance of $65.4 million, which represent the total “liquid” funds at their disposal. Of this amount, there was $3 million either in the Town’s bank or “on-hand” in the form of cash. This means that $62.4 million was tied up in investments, with approximately $3 million actually available for the Town’s immediate day-to-day activities to pay bills.

Since the Town has a “pooled funds” policy, this allows them to deposit ALL revenues from ALL sources into one account, and then pay their bills for ALL activities from this same account. This means, that the total funds “Held Directly” will increase as revenues received from the various sources outweigh the expended funds, or will decrease if the opposite is true.

As you look through each of the months, the “Water, Wastewater, Storm-Drainage” revenues always outweigh the expenses, except for June, due to capital expenditures/improvements. The “All Other Accounts & Other Sources” have very limited revenues received, up until June when property taxes are paid by the Town’s residents. For the months of April, May, and July, the expenses outweigh the revenues.

So the question becomes how did the Town pay the bills for the Town’s operations, especially since they did not physically receive the necessary revenues to do so (specifically April, May, and July), the investments “Held Directly” always went up (except for July), and the “bank account” was never funded from their investments?

As I have contended, since the town pools ALL funds together in the same account, there becomes no differentiation between “water bill payment” funds, “tax bill payment” funds, or any other revenue funds received. The Town, up until property taxes are received in April-June, RELIES on the water bills to fund the Town’s operations, so that they do not have to pull funds from their investments (which they actually add to, since the “Total Held” goes up EVERY month except for July).

Since the Town would never come to the residents and say that they are using this practice, there will not a document or some official report which says that they are. However, when you actually go through the financials methodically, as explained above, the information that I provided proves that they are in fact, relying on and using the funds from water bill payments. They do this through “pooling of funds” by simply mixing those funds with other funds. While this practice may be considered “kiting”, they are really “floating” funds, but as long as they show where expenses and revenues came from or went on their year end financials which are audited, they have and will continue to get away with it. This does not at all mean it is right though.

The Town’s expenses have increased almost every year as seen in the financial reports that are available from the town. As the Town becomes larger, there are more expenses incurred to operate. In similar fashion, the water/sewer/storm-drainage base rates increase every year, and these rates are provided as a recommendation from the Town’s Finance Department, which are then approved by the Board of Trustees. The way it has come to be, it basically means our water bill payments are a tax, with rates that increase every year (which “Enterprise Funds” are NOT supposed to be a form of a tax).

Transparency is the single most and largest concern regarding this topic. I would want to adjust some of the accounting and financial practices and reporting that our Town currently uses. I would separate the two accounts out so that there are two separate and distinct funded bank accounts. I would only “pool” the funds that are “enterprise fund” activities into one single account, and then have another for all other operations. For reporting, I would like to see the transparency needed. I would like to see the two separate accounts reported independently of each other in terms of “cash on hand”. I understand that the financial statements do have similar statements reflecting this, but I want to see, as in the bank accounts and the actual investments made, which has how much funds depending on the activity. Instead of simply showing “pooled funds”, show “Enterprise pooled funds” and “general town operations pooled funds”. This would truly make it so that each of the accounts stand on their own, so that each is completely independent and self-reliant on only itself.

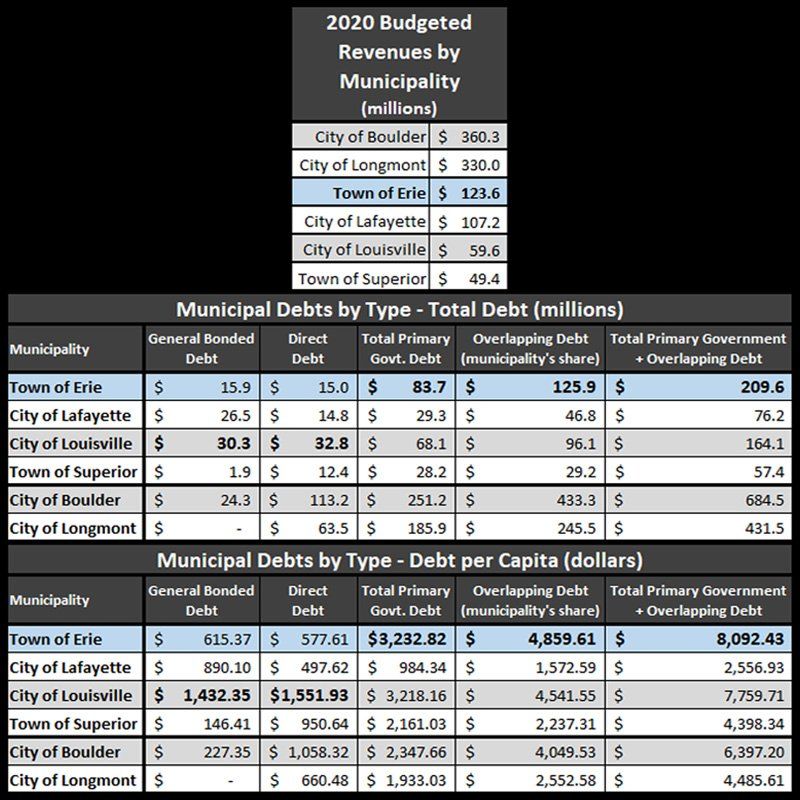

I also issued an infographic which showed just how much debt the Town has incurred. The information I presented highlights the fact, that relative to all of the largest municipalities within Boulder County, the Town of Erie has more "Total Primary Government and Overlapping Debt per Capita" than any other municipality, and also has more revenues and debt than any other town, except for the largest 2 cities of Boulder and Longmont (which is expected from municipalities of their size, since they do also have very specific bonds which are repaid solely from sales taxes, and are able to repay the bonds in a fairly short amount of time due to their large revenue base).

I have presented this information, and presented my article on Town Finances, to shed light on how the Town has incurred a very large amount of debt ($209.6 million) to ultimately fund the Town’s operations. While debt and bond issuance is used by a large percentage of other municipalities in Colorado and nationwide, in Erie's case, this is being done in a very methodical, multi-step, and complicated fashion, which has then been amplified by the decisions made of current and former Town administrations. Previous administrations have made the decisions to both garner vast amounts of residential development, as well as to deploy a water, sewer, and storm water "Enterprise fund" in order to attain this residents, and then grow the Town's operations through these efforts.

The graphic above illustrates just how much “Total Debt per Capita” that, we the residents, have each had placed upon us ($8,092.43), and have unknowingly been paying for along the way. We the residents, have been paying this in our water/sewer/storm-drainage bills, and through our ever increasing taxes. We have not only been paying for the principal on the debt issued by the Town, but also for the interest too - since the bond holders also receive an additional percentage of the amount they originally paid for the bond - in addition to the above and beyond mandated amount outlined by the Town's agreements when issuing the debts.

The graphic above illustrates just how much “Total Debt per Capita” that, we the residents, have each had placed upon us ($8,092.43), and have unknowingly been paying for along the way. We the residents, have been paying this in our water/sewer/storm-drainage bills, and through our ever increasing taxes. We have not only been paying for the principal on the debt issued by the Town, but also for the interest too - since the bond holders also receive an additional percentage of the amount they originally paid for the bond - in addition to the above and beyond mandated amount outlined by the Town's agreements when issuing the debts.

Why the Town has relied on Residential Development

In addition to the bonded debts that we have incurred directly resulting from the Town’s practices, the Town’s residents also

have a share of debt placed on them from the "overlapping debts"

incurred by other governmental bodies within the region. As they

issue specific bonds that pertain to projects within Erie's jurisdiction, so too does the Town. Even though the bonds are say issued for “St. Vrain School District” and you might live in “Boulder Valley School District’s” boundaries, the Town could potentially become financially liable, where all of the Town's residents are held responsible for the share of their debt obligations, due to specific "Intergovernmental Agency (IGA)" agreements that were made years prior (I will go further into IGAs and the Town's Relationships with local municipalities/agencies at a later date, but this is just one of the many reasons why they are important).

As the article that I wrote discusses, this debt has required

and depended on the Town's ability to increase residential development, in order to:

- Increase the total tax revenues, by increasing the total number of taxable properties, which increases the “total taxable value” (ie. the taxable amount of all

properties in Erie, including your own);

- Increase the water/sewer/storm-drainage revenues received, which is reliant on increased usage, how much residents pay for services, and the tap/connection fees paid by developers;

- Allow for more debt to be extended through the Town's issuance of bonds, in order to fund additional future expenditures for capital projects.

As my article discussed, the Town has used the debt mechanism of bond issuance, and other instruments, which allow for them to avoid attributing these debts to their "General Obligation", which would normally be capped by a “legal debt limit” as set by state law. "This “legal debt limit” is also dependent on “total taxable value”, since it is a straight percentage of this aggregated total. (It is also important to note, that these bonded debts effect the "proprietary funds" aka. "Enterprise funds" account, which follows a non-GAAP modified accrual budgetary basis, meaning the "financial reporting" is not always reported "as transparently", nor is it even audited in the same manner as the standard Town financials are).

Why the Town has relied on residential development, revenues from water, and demand for water for their Bond ratings

The Town too has required

residential development specifically to issue their 3 bonds:

- Erie GOULT Bond:

This is the Town’s general obligations UNLIMITED

tax bond. It is reliant on taxes and residential developer fees. It is secured by the Town's “total taxable value”, and the fact that the bond potentially allows for, if required, the Town to tax 100% OF THE "TAXABLE ASSESSED VALUE". The bond's rating could be improved by specific investor services when there is a larger “total taxable value” for Erie to tax.

- Erie Water Enterprise Bond:

This is the Town’s water “Enterprise fund” bond. It is reliant on the residential service fees and tap/connection fees. It is secured by the revenues that the Town receives from residents, and from the payments we make for water services. The bond's rating could be improved by specific investor services when there is more demand for water services, or when the system's size and service revenues increase.

- Erie Sewer Enterprise Bond: This is the Town’s sewer “Enterprise fund” bond. It is reliant on the residential service fees and tap/connection fees. It is secured by the revenues that the Town receives from residents, and from the payments we make for sewer services. The bond's rating could be improved by specific investor services when there is more demand for sewer services, or when the system's size and service revenues increase.

How the Town's overlapping debt is actually debt for all residents

Let's take for instance the Meadowlark K-8

school completed and opened in the Fall of 2017, which is within the Flatiron Meadows community, and services residents within the Boulder Valley School District's (BVSD) boundary. An IGA was agreed upon in 2001, then re-agreed upon in 2011, between the Town of Erie and BVSD. This agreement included, among other things, financial assistance for BVSD projects related to projects effecting Erie residents.

This specific IGA, which is similar and not unlike many of the other IGAs that the Town has agreed to additionally with various local agencies, means that the Town of Erie has their own respective share of the debt, which they too are financially obligated to cover. This means that we, the residents of Erie, are financially obligated as well.

The Town's debt practices - the past, present, and immediate future

The Town's debt practices - the past, present, and immediate future

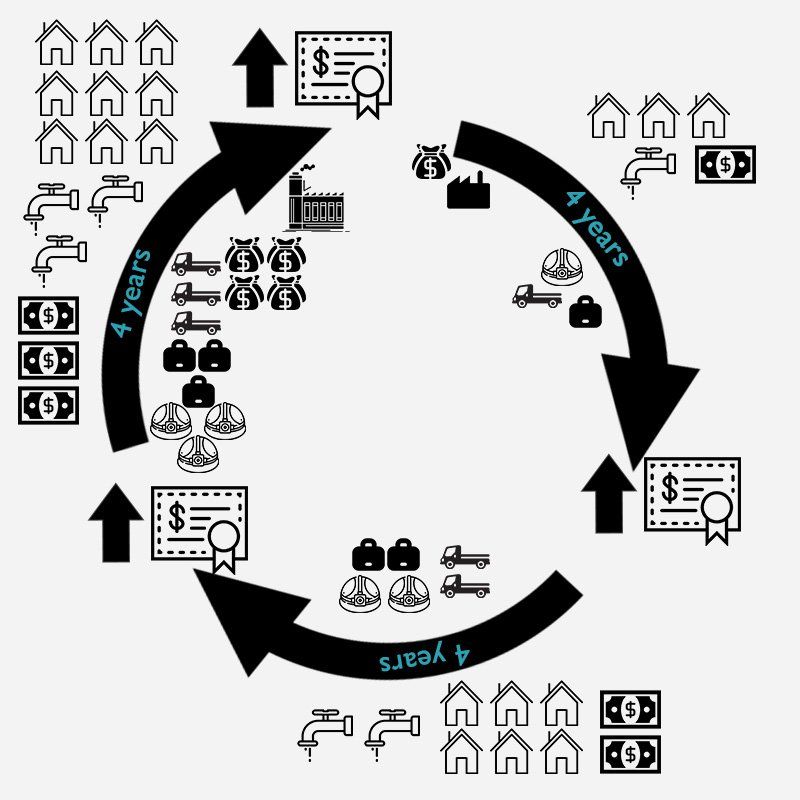

As I stated in my original article, "While debt is fine in certain situations, the way that the Town has been using it for over the past decade is becoming reckless." For instance, the upcoming expansion necessary to increase capacity for the North Water Treatment facility should

use a portion of debt to finance the operations. Why? Because at this moment, we do not have the funds necessary to do so otherwise, because the funds have not been reserved properly for future needs. Instead, it has been a very cyclical process where we have a population that grows quickly, our infrastructure becomes strained, it requires large capital expenditures, we pay for them with bonded debt, it increases our Town's revenues at the cost of the residents, and then restart the process over again when our population grows rapidly once again.

For illustration purposes, let's take a look at 2 different models of cycles, the first being the "Even Keel Model" cycle:

The Town first issues debt for a smaller "Enterprise" facility that can withstand the capacity of up to 12 years of stable growth, "Enterprise" usage is limited, but so too is the size of the Town's government, the number of homes, the total taxable value, the number of employees necessary for the Town, etc. The debt was issued before the revenues to pay for the facility, before the water usage fees, etc. were fully in-hand, but it was assumed that the Town would grow at a pace that was manageable. For arguments sake, say every 4 years, the Town would grow, and so too would the number of employees, and all of the other aspects described earlier, but at a proportional pace. The taxes and revenues received would increase, just as would the bond rating because of the increased demand. Say after 10 years, they saw that there was a need for more infrastructure, so they incurred some debt, but the demand was large enough, and the revenues received for services also warranted it. Then say after the 10th year of incurring the Original debt, they paid it off from the taxes and service fees associated with their Enterprise activities, because they planned for it well, and were actually ahead of schedule. Then the new facility was built after 12 years, but it could take on 50% more capacity, so it would withstand at least another cycle. And so on, and so on. Hint, this is the model that Erie originally "planned".

Now, let's look at the "Asleep at the Wheel Model" cycle:

The Town did the same thing as the "Even Keel Model", to a "T". But then, after 4 years, the Town administration changes, and they decide "hey, let's quickly ramp up the number of residential communities that we have! It will make it so we receive more water revenues, meaning quicker infrastructure projects, that are bigger, badder, and bolder. And it will mean more taxable revenue, since we have more homes! Also, it will mean that our bond ratings will increase meaning we can receive debt easier and issue more of it to pay for things!"

So they do that, and it works - residential development is booming! They decide that they want to start issuing debt to fund more projects, because again - it's booming and they are receiving fabulous rates with a great bond rating! Well, no one is paying attention to just how quickly it's booming. And they only increase the number of employees like they had originally planned under the "Even Keel", which doesn't keep up with the pace properly. And yet still, they keep packing houses in, more and more, until - oops! We "planned" for 12 years capacity for our "Enterprise" usage, but its only been 7, and we are maxed out. So they issue debt to pay for this, in addition to the debt that they have already been issuing for the other projects. Well, now they are at a point, where yes, their taxable revenues are higher, and yes, they have these wonderful facilities which receive lots of revenues, at the residents expense. But it still doesn't pay for the amount of expenditures to expand the facilities, except they are at the point where they have to expand because they were sleeping at the wheel.

Hint: this was the model that Erie actually took

Hint: this was the model that Erie actually took

How to end this cycle

We need to break this cycle by outlining a path which is Forward Thinking. If the Town continues on their current path, using debt too quickly and too often (as I predict will continue to be the current track, since we are already seeing various infrastructure systems become strained

as we speak), or if residential construction slows, this would not only downgrade our bond ratings, but we would be held responsible for the Town's debt obligations. Let's face it, the Town would never provide us with a refund if they had more cash-on-hand then necessary, (since after all, the voters did approve a measure in 1994 which essentially eliminated all TABOR restrictions for the Town), but they have no problem continuously increasing our rates in order to pay their financial obligations. Which means that we, the residents of Erie, are the ones truly guaranteeing these bonds - not the Town, or the water department.

Now that this issue has been addressed, it allows for solutions to be brought forth that allow the Town to self-fund the projects and operations. Which as mentioned in my previous article, will be “Economic Development”.

Click here to read blog post, "Town Finances: Part 1", explaining exactly how all of this is true

Topic for Next Time: Economic Development

*Just a side note to all of the items that I discuss: I am a solutions driven problem solver by nature. I wonder how things work, why they work the way they do, and how to make them better. This means seeking different, outside-the-box methods to figure out solutions to various issues. Accordingly, I am always open to learning new ideas, different ways of doing things, as well as constantly learning from others' experiences to make better decisions. When I see an issue, I view it in a holistic fashion, and then dive into specific areas to remove deficiencies and create efficiencies. If you, who are reading this, have some thoughts or ideas about any of the subjects I discuss, I would be more than happy to speak with you to hear your opinions. Please reach out to me here through my website. Listening, hearing, and understanding different perspectives is the only way that we can all grow and create positive change - by learning from others, and delivering ideas that push the needle to become Forward Thinking.

Share

Projected to be depleted by 2027, Erie's finance team forecasts the Town's Capital Fund to only have $2.5million available for capital projects (after $4million Street Maintenance) from 2027 through 2029 — due to overspending caused by operational and capital expenses exceeding the growth of revenues

While some call it an "Affordable Housing" issue, in reality the root of the problem is a lack of housing diversity. During the Town's massive growth over the years, a lack of available inventory and the national housing market have created a housing affordability issue as the Town's makeup has comprised almost entirely of single family homes. The best way to resolve this issue is to work with our stakeholders in the community - our development partners - to address the cause, not the symptoms of the issue.

Erie has quickly moved from "the best kept secret" to "the gem of North Metro Denver", becoming a destination that others want to call home. In order to set our Town up for the best chances for success, a plan must be created that provides us with an ability to manage our current and future growth.

The blueprint below is designed to do just that, providing an understanding of where we are now (our "Current Position"), where we are going (our "Upcoming Needs"), and where we want to be (our "Future Growth"). It starts with assessing what's needed at this moment, preparing for what's needed later, and then having a vision to plan for the future.

Tell us briefly about yourself and where you are from and why you think you're a good candidate for the position you are running for: Originally from the Chicagoland area, I have been a resident of Erie since 2016, previously a resident of Broomfield for 7 years. I graduated from CU Boulder in 2009, with a Bachelor of Science degree in Business Administration with dual concentrations in Management and Marketing. I am a business operations and marketing professional, with experience growing businesses from the ground up. Currently, I serve as the Sr. Manager of Customer Operations for a data analytics software company. As a solutions-driven individual, I use a holistic-view approach to identify and resolve issues that deliver results, which are both effective and efficient. I am married to my amazing wife, Gabrielle, and am the doting father of my two husky fur-babies, Kaia and Koda. I currently serve as both a Planning Commissioner and a Comprehensive Plan Amendment Steering Committee member for the Town. As an individual from the business world, I believe the Town needs leaders who can create solutions that will be positive and Forward Thinking for Erie’s Future. I believe that I am a good candidate for the position of Trustee because I am committed to making Erie the thriving and sought-after place to live, work, and raise a family - the place we love to call "home"!

I have recently been asked my stance on the Town's current face coverings order. This is an issue which by now, I am sure we have all formed our own personal opinions on. Since 2020, it has affected our daily lives and has been a “hot topic” locally, nationally, and world-wide. It has created division between families, friends, neighbors, communities, and nations alike – and likewise, Erie too has also seen its fair-share of division surrounding the subject. Personally, I abide by the orders issued by a county’s Public Health Agency, as their respective agency has final-say on the specific orders currently in place within their respective boundaries. As well, I abide by the requests and policies of a business which may not be under a mask mandate, but request that patrons within their establishment wear one. However, as I will go into further, the current Town of Erie Face Covering order is in actuality an overreach of legal authority applied to the Weld County side - due to Erie not having its own Public Health Agency, and due to Public Health order which was referenced in the Town's order being from the Boulder County Health Department. The decision made by the Board of Trustees and Town Administrator to administer this upon those in Weld County has not only hurt our businesses, but it has as well placed our Erie Police Department in a situation which they have no option but to enforce the order. The Erie Face Coverings Mandate Erie is uniquely situated in a location where we are split between two counties, with each county having differing views when it comes to various topics – and COVID has been no different. Statutorily, CRS §31-15-103 notes that the Town has the power to issue ordinances “which are necessary and proper to provide for the safety, preserve the health” of the Town’s residents. As well, we are statutorily provided with the authority to create our own Board of Health, as described in CRS §31-15-201 (1) (c), as well additionally in CRS §25-1-507 which notes:

First off, this issue has nothing to do with the capabilities of our Town's current Finance team. I am in no way, shape, or form "throwing them under the bus." I think they are doing a fabulous job, and are making amazing strides in rectifying many issues that they ultimately inherited. These issues should have been found out sooner, and lies entirely and squarely on the shoulders of previous Board of Trustees, as well as our Town Administrators. These individuals are the leaders within Town Hall. They are the individuals who are either our elected, or appointed by those elected, to be Stewards of our Town's finances. Our next board must contain individuals who understand the Town's budgets and finances, who review them thoroughly - as well as those who provide scrutiny, ask questions, and request clarification on these items (and others) from Staff. As someone who believes that our Town's Financial Wherewithal is an extremely important topic for our Town's future success, and having identified this issue in 2020 , I am disappointed in our Town's leadership for placing this situation upon our Town's Finance department. I am providing this information because of the opaque nature in which our Town has acted with in years past. I am also providing this information because there are many more issues that these individuals are attempting to rectify at this very moment, some that might take a year or two to finally be able to accomplish, as well as to say to our Town's Finance Department (Stephanie and Candice - and Victoria who just left as well) "Thank you for all that you are doing to illuminate and resolve these issues for our Town!" Backstory After my last article regarding the Town's 2022 Budget and the changes made within, another Trustee Candidate and myself were discussing the Town's budget online, referencing both the Town's Comprehensive Annual Financial Report's and Monthly Financial Reports in our comments. Less than a week later, I noticed that the Monthly Financials were removed from the Town's website. I decided to post on my Candidate Page about this in jest, and tagged the Town's official Facebook account - assuming that I wouldn't actually receive a response about it.

The General Fund is the primary operating fund for the Town. This single account is where all revenues and expenses are allocated relating to Town Administration, Legal, Legislative, Parks and Recreation, Public Works, Finance, Economic Development, Communications and Community Engagement, HR, IT, Public Safety, and Central Charges (ie. Debt and Transfers to other funds). The revenues that fund this account results from our sales taxes, property taxes, development related fees, recreation fees, landfill fees, oil and gas related income, and other miscellaneous sources. Adopted by the Board of Trustees in November, this year’s budget was prepared for the first time in over 10 years by someone other than our previous Finance Director. The 2022 General Fund Budget projects a total of approximately $42.6 million in revenues for the Town. This is an increase from approximately $36.1 million in 2021, for a year-over-year growth of $6.5 million or 18%. At first glance this might look great, but the Budget then continues to explain that this double-digit growth is largely just a result of an “accounting change.”

As we all practice social-distancing and isolation due to COVID-19, what happens when we run out of activities to do around the house? Below are many different items - ALL COMPLETELY FREE - including educational materials for children, books, music, and virtual activities, in order to continue learning or simply pass the time. Have more items to add to the list? Send me a message here or on Facebook . (I will continue adding to the list as additional suggestions come in - but remember, they must be FREE!) ACTIVITIES Fitness 1440 - Erie Virtual training for its members on their Facebook page, to help stay mentally and physically active (On-Demand FREE for current members, Facebook video classes also posted for current and non-members) (just a side note: you can still also purchase their smoothies, picking them up curbside from 10am-12pm, by texting or messaging your order to them!) https://www.facebook.com/fitness1440erieco/ Virtual Field Trips Take a virtual trip to locations arround the world: View exhibits from The Louvre Museum in Paris, the Anne Frank House in Amsterdam, explore the surface of Mars, and more http://freedomhomeschooling.com/virtual-field-trips/ Virtual Disney World Rides Even though the Disney parks are closed, you can still ride their rides virtually online https://www.wesh.com/article/virtual-disney-world-rides/31782946 Paris Musées Virtual Exhibit Collection of 150,000 digital art reproductions in High Definition of works in the City’s museums http://parismuseescollections.paris.fr/en GoNoodle Movement and mindfulness videos created by child development experts https://www.gonoodle.com/ CHILDREN'S EDUCATIONAL MATERIALS - GAMES, LEARNING, & VIDEOS Khan Academy Expert-created content and resources for every course and level (requires sign-up) https://www.khanacademy.org/ Newsela content from the world's most trusted providers and turn it into learning materials that are classroom-ready https://newsela.com/ XtraMath Program that helps students master addition, subtraction, multiplication, and division facts https://xtramath.org/ Teachers Pay Teachers Online marketplace for original educational resources with more than four million resources available for use (requires sign-up) https://www.teacherspayteachers.com/ Create Printables Variety of worksheets and printables ideas to personalize for your child https://www.createprintables.com/ PBS Kids Educational games and videos from Curious George, Wild Kratts and other PBS KIDS shows https://pbskids.org/ Sesame Street Play educational games, watch videos, and create art with Elmo, Cookie Monster, Abby Cadabby, Big Bird, and more of your favorite Sesame Street muppets https://www.sesamestreet.org/ Education.com A library of games, activities, educational worksheets, and lesson plans for PK-5th, curated by educators (requires sign-up) https://www.education.com/ BrainPOP Animated Educational Site for Kids - Science, Social Studies, English, Math, Arts & Music, Health, and Technology https://www.brainpop.com/ (Normally this is a paid subscription service, but they are offering free subscriptions due to the COVID-19 pandemic) Starfall Allowing children to have fun while they learn - specializing in reading, phonics & math - educational games, movies, books, songs, and more for children K-3 https://www.starfall.com/ BOOKS (KIDS AND ADULTS) Magic Blox Offers a large library of free online books & children's stories https://magicblox.com/ Epic! Digital library for kids offering unlimited access to 35000 of the best children's books of all time (30-day free trial available) https://www.getepic.com/ Open Library Collection of books from the Library of Congress, other libraries, and Amazon.com, as well as other contributors https://openlibrary.org/ Project Gutenberg Library of over 60,000 eBooks, including free epub and Kindle eBooks, download them or read them online https://www.gutenberg.org/ TV & MOVIES Tubi Stream and watch movies and TV shows online in HD on any device https://tubitv.com/ Pluto TV Watch 250+ channels of TV and 1000's of on-demand movies and TV shows https://pluto.tv/ MUSIC Spotify Digital music service that gives you access to millions of songs https://www.spotify.com/us/free/ Pandora Music streaming and automated music recommendation internet radio service https://www.pandora.com/ TuneIn Radio Internet radio, sports, music, news, talk and podcasts https://tunein.com/

Current and previous leaders have not addressed the items which they said they would. As a resident, I am tired of seeing Erie's potential squandered. That is why I am saying "no more!", and why I am running for Trustee. This is why I will focus on the most pertinent issues that I see, as well as the items that are most important to you, the Town's residents